Listerhill Drew Edwards has become a standout figure in the world of community banking. With a strong focus on integrating technology and a deep commitment to serving the community, Edwards has been instrumental in reshaping how financial institutions can better support their members. His innovative approach, blending modern solutions with personalized banking services, has made a lasting impact on the financial landscape.

Under Edwards’ leadership at Listerhill Credit Union, the organization has flourished by adopting forward-thinking strategies, prioritizing member needs, and engaging in meaningful community development initiatives. From financial literacy programs to enhancing accessibility for underserved populations, Listerhill Drew Edwards is setting new standards for community-focused banking.

Who is Listerhill Drew Edwards? A Leader Shaping Modern Community Banking

Listerhill Drew Edwards is a key figure in modern community banking, known for his innovative ideas and commitment to serving local communities. As the leader of Listerhill Credit Union, he has transformed traditional banking by focusing on both technology and human connections. His leadership style is all about making banking easy and accessible for everyone, especially those in underserved areas.

Edwards believes in a balance between modern banking solutions and personal relationships. He understands that people need both efficient tools and real support to manage their finances. This has made him a standout leader in the financial world, where many banks are moving towards impersonal, tech-only solutions. Under his leadership, Listerhill Credit Union has become a trusted name for members who value both innovation and personal service.

Early Life and Career: How Listerhill Drew Edwards Developed a Passion for Finance

Growing up in a small town, Listerhill Drew Edwards saw firsthand how financial stability could shape lives. This early exposure to the importance of community support sparked his interest in finance. He knew that by improving access to financial services, he could make a positive impact on people’s lives. His desire to help others led him to pursue a degree in finance, laying the foundation for his future career.

Starting from entry-level positions, Edwards worked his way up, learning the ins and outs of banking. His dedication and forward-thinking ideas helped him move quickly into leadership roles. His journey through the ranks of Listerhill Credit Union showed his deep commitment to both the institution and its members.

The Visionary Leadership of Listerhill Drew Edwards at Listerhill Credit Union

Focus on Community Well-Being

Listerhill Drew Edwards is recognized for his visionary leadership at Listerhill Credit Union. His approach has been to focus not only on financial growth but also on the well-being of the community.

Introduction of Innovative Services

Edwards has introduced new services and programs that help members achieve financial stability, emphasizing the credit union’s core mission of community support.

Listening to Member Needs

Edwards’ leadership is rooted in listening to the needs of the credit union’s members. He believes in creating solutions that are both practical and forward-thinking.

Staying Ahead in a Competitive Market

This vision has allowed Listerhill Credit Union to stay ahead in the competitive financial market while remaining deeply connected to its members’ needs.

Merging Technology with Personal Touch: Edwards’ Innovative Approach to Banking

Under the guidance of Listerhill Drew Edwards, Listerhill Credit Union has successfully merged technology with personalized service. Edwards recognized early on that banking was changing, with more people looking for fast, easy-to-use digital tools. He led the charge to implement mobile banking, online tools, and apps that make banking accessible anywhere, anytime.

However, Edwards also knows that technology alone isn’t enough. He has balanced this by ensuring that members can still rely on personalized customer service. Whether it’s face-to-face interactions or digital support, Edwards’ approach ensures that every member gets the help they need in a way that works best for them.

How Listerhill Drew Edwards Enhances Accessibility for Underserved Communities

One of Listerhill Drew Edwards’ main goals has been to make banking accessible for everyone, especially underserved communities. He understands that many people face barriers when it comes to financial services, and he has worked hard to remove those obstacles. His focus on inclusivity has led to the creation of programs that provide financial education and affordable banking solutions.

Edwards has introduced initiatives that help low-income families, young adults, and others who might not have easy access to traditional banking. By offering tailored services, he ensures that more people can benefit from Listerhill Credit Union, regardless of their financial situation.

The Importance of Community Engagement in Listerhill Drew Edwards’ Strategy

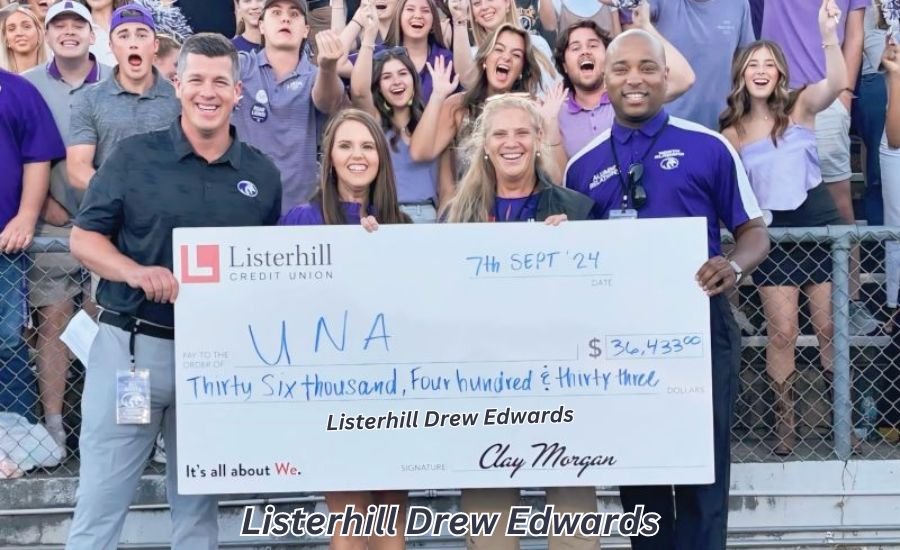

For Listerhill Drew Edwards, community engagement is a key part of his banking strategy. He believes that financial institutions should do more than just offer services—they should also be actively involved in the communities they serve. This philosophy has led to numerous community-based programs that aim to improve the overall well-being of members.

Edwards has pushed for partnerships with local organizations, schools, and non-profits to strengthen the community. These efforts not only help individuals but also create a sense of togetherness. His belief in giving back has made Listerhill Credit Union a trusted partner in community development.

Promoting Financial Literacy: Edwards’ Role in Empowering Communities

Financial literacy is one of the cornerstones of Listerhill Drew Edwards’ community outreach. He understands that without the right knowledge, many people struggle to manage their finances effectively. To tackle this, he has launched various educational programs that teach budgeting, saving, and investing skills.

Through these initiatives, Edwards empowers individuals to take control of their financial futures. The impact of his efforts is seen in the increased financial stability of members who participate in these programs. By promoting financial literacy, Edwards is helping to build stronger, more financially secure communities.

Technology-Driven Solutions: How Edwards is Attracting Younger Generations to Listerhill

Understanding the Needs of Younger Generations

Listerhill Drew Edwards has made attracting younger generations a priority at Listerhill Credit Union. Understanding that young people are often tech-savvy and prefer digital solutions, Edwards has introduced a range of technology-driven services to meet their needs.

Innovative Digital Offerings

From mobile banking apps to online financial planning tools, Listerhill now offers solutions that appeal to a younger demographic. These advancements have not only made banking more convenient but have also helped build loyalty among younger members.

Building Loyalty Through Technology

Edwards’ focus on technology ensures that Listerhill Credit Union remains relevant in an ever-changing financial landscape.

You May Also Like: Lubsb500

Building Partnerships: Listerhill Drew Edwards’ Collaborations with Schools and Non-Profits

Community partnerships are a key part of Listerhill Drew Edwards’ leadership strategy. He has forged strong relationships with local schools, non-profits, and businesses to better serve the needs of the community. These collaborations focus on providing financial education, supporting local initiatives, and helping individuals achieve financial stability.

By partnering with these organizations, Edwards ensures that Listerhill Credit Union is not just a financial institution, but a community partner. His work with schools helps teach financial literacy to the younger generation, while his partnerships with non-profits ensure that essential services reach those who need them most.

Innovative Banking Solutions: Listerhill Drew Edwards’ Approach to Modern Financial Services

Listerhill Drew Edwards is always looking for ways to improve banking services for Listerhill Credit Union members. His focus on innovation has led to the introduction of modern financial solutions that make banking easier and more efficient. These include digital tools that help members manage their money, as well as new products that cater to specific needs, such as small business loans and savings programs.

Edwards’ approach to innovation is centered on making banking more accessible and user-friendly. He ensures that every new service is designed with the member in mind, providing solutions that fit the busy, modern lifestyle while maintaining a personal touch.

The Future of Community Banking Under Listerhill Drew Edwards’ Leadership

Listerhill Drew Edwards is shaping a progressive future for community banking. Under his leadership, Listerhill Credit Union aims to blend modern technology with personalized banking services, making financial tools more accessible and user-friendly.

- Integration of Technology: Listerhill Credit Union will incorporate modern technology into banking services to enhance user experience.

- Personalized Banking Services: The union will maintain a focus on personalized service, ensuring that members feel valued and supported.

- Seamless Digital Experience: Development of mobile apps and online banking features will create a more accessible and user-friendly banking environment.

- Expanding Access: Edwards aims to broaden banking access to underserved populations, ensuring everyone has the opportunity to use quality financial services.

- Inclusivity Initiatives: Introduction of new services specifically designed for individuals and small businesses that may feel neglected by larger banks.

- Community-Centric Approach: The focus will remain on building relationships within the community, prioritizing customer needs and feedback.

Conclusion

Listerhill Drew Edwards is making big changes in community banking. His ideas focus on using technology to make banking easier for everyone. By creating apps and online services, he wants to ensure that people can manage their money without any hassle. Edwards also believes it is important to keep the personal touch, so members feel like they are part of a caring community.

Edwards’ goal is to help everyone, especially those who may not have had good banking options before. He wants to make sure everyone has the chance to use quality financial services. With his leadership, Listerhill Credit Union will continue to grow and adapt to what people need. This way, community banking will be ready for the future and serve everyone better.

Read More: HP Pavilion Desktop

FAQs

Q: Who is Listerhill Drew Edwards?

A: Listerhill Drew Edwards is the leader of Listerhill Credit Union, known for his innovative approach to community banking and commitment to improving financial services.

Q: What is the vision of Listerhill Drew Edwards for community banking?

A: Edwards aims to blend modern technology with personalized services, making banking more accessible and user-friendly for everyone in the community.

Q: How does Listerhill Credit Union support underserved populations?

A: The credit union focuses on expanding access to quality banking services for underserved communities, ensuring everyone has opportunities to manage their finances effectively.

Q: What role does technology play in Listerhill Credit Union under Edwards’ leadership?

A: Technology is integrated into banking services through mobile apps and online tools, creating a seamless experience while keeping personal interactions intact.

Q: Why is community engagement important to Edwards?

A: Community engagement helps build strong relationships, allowing the credit union to understand and meet the needs of its members better.

Q: How does Listerhill Drew Edwards promote financial literacy?

A: Edwards leads initiatives that educate community members about budgeting, saving, and investing, empowering them to make informed financial decisions.